Scalping, a trading strategy that aims to capitalize on small price movements within very short time frames, can be highly lucrative but also demands a disciplined and well-planned approach. One of the foundational steps to successful scalping is choosing the right broker. Traders need a broker that offers low commission fees because the small profits per trade can quickly be eroded by high transaction costs. Additionally, fast execution is critical to ensure that orders are filled promptly, allowing traders to take advantage of minor price fluctuations without significant slippage. A reliable trading platform with real-time data and minimal downtime is also essential to maintain continuous and accurate market access.

Focusing on liquid markets is another key aspect of scalping. High liquidity ensures that traders can enter and exit positions swiftly without causing large price movements. This is particularly important in forex markets, where major currency pairs like EUR/USD or USD/JPY offer tight spreads and high liquidity. Tight spreads are crucial for scalping since wide spreads can substantially reduce profitability by increasing the cost of each trade.

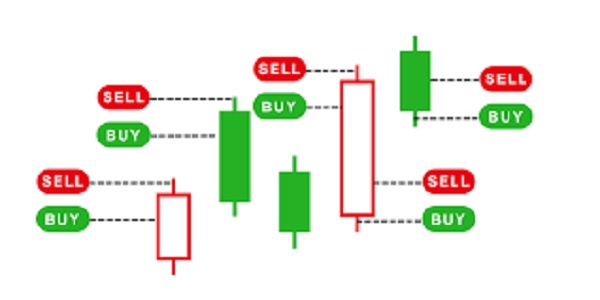

Developing a robust trading plan is indispensable for scalpers. This plan should clearly define entry and exit points, often determined using technical analysis tools such as moving averages, Bollinger Bands, and support and resistance levels. Setting stop-loss orders is essential to protect capital and limit potential losses. Given the rapid pace of scalping, maintaining discipline in risk management is crucial. Scalpers also need to set realistic profit targets, aiming for small, consistent gains rather than large profits from individual trades.

Utilizing technology can greatly enhance the efficiency and effectiveness of a scalping strategy. Advanced trading software and algorithms can help identify trading opportunities and execute trades quickly. For those involved in high-frequency trading, automated trading systems or bots can execute trades based on predefined criteria, reducing the need for constant manual intervention and enabling traders to capitalize on fleeting opportunities.

Effective risk management is at the core of successful scalping. Keeping position sizes small relative to overall capital helps minimize risk. It's important to avoid overtrading, which can lead to significant losses, by sticking to the trading plan and avoiding impulsive, emotion-driven decisions. Maintaining a trading journal can be particularly beneficial, allowing traders to document their trades, analyze outcomes, and refine their strategies over time.

Staying informed about market news and economic events is also vital for scalpers. Significant news can cause abrupt price movements, providing both opportunities and risks. Utilizing economic calendars helps traders anticipate and prepare for important data releases and announcements that could impact the markets they trade.

Technical analysis plays a significant role in scalping. Familiarity with common chart patterns and technical indicators can help traders identify potential price movements and market conditions. Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and stochastic oscillators can signal overbought or oversold conditions, guiding entry and exit decisions.

Discipline and focus are critical in scalping. Traders must adhere strictly to their trading plans and manage emotions to avoid impulsive decisions that can lead to losses. Scalping can be stressful due to its fast-paced nature, so stress management techniques are important to stay calm and focused. Continuous learning and staying updated with new techniques and market trends can also enhance a scalper's effectiveness.

Finally, optimizing trading hours is crucial for maximizing the potential of scalping. Trading during the most active market hours, such as the overlap of the London and New York sessions for forex traders, provides higher volatility and liquidity. Avoiding periods of low volatility, where price movements are minimal, helps ensure that each trade has a better chance of being profitable.

In summary, successful scalping requires a well-thought-out approach that includes choosing the right broker, focusing on liquid markets, developing a robust trading plan, utilizing technology, managing risk effectively, staying informed, practicing technical analysis, maintaining discipline, and optimizing trading hours. By adhering to these principles, scalpers can improve their chances of success and make the most of the opportunities presented by this dynamic trading strategy.